The Federal Deposit Insurance Corporation (FDIC) recently issued its first quarter 2024 Quarterly Banking Profile. The report provides financial information based on call reports filed by 4,568 FDIC-insured commercial banks and savings institutions. The report also contains a section specific to community bank performance. In the first quarter of 2024, this section included the financial information of 4,128 FDIC-insured community banks. BerryDunn’s key takeaways from the report are as follows:

The first quarter of 2024 resulted in community banks’ quarterly net income increasing $363.2 million from the previous quarter.

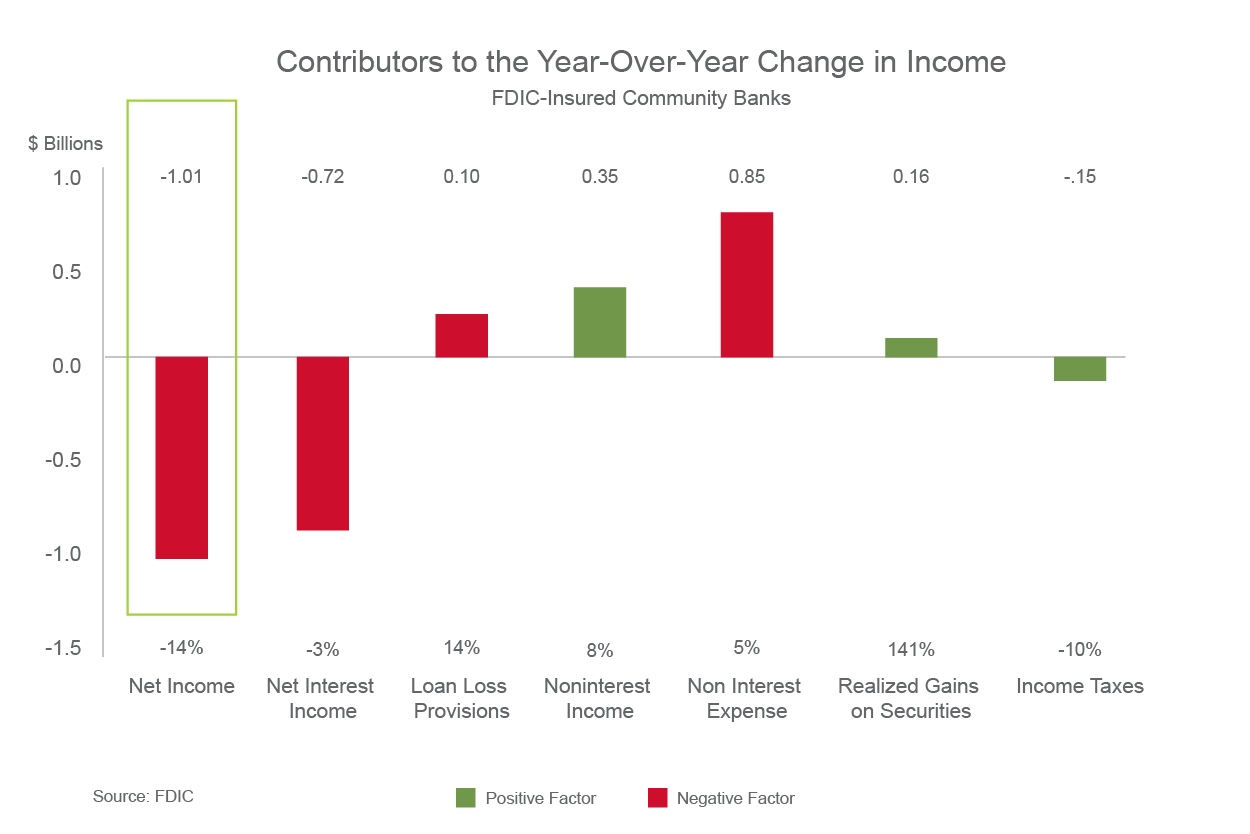

Quarterly net income for community banks increased 6.1% in first quarter 2024, resulting in $6.3 billion of quarterly net income. Despite the increase in quarterly net income, full year net income declined. Compared to first quarter 2023, net income had decreased $1 billion or 13.9%. Half (49.9%) of all community banks reported a decline in net income compared to fourth quarter 2023. Net income for community banks was impacted by higher noninterest expense and lower net interest income.

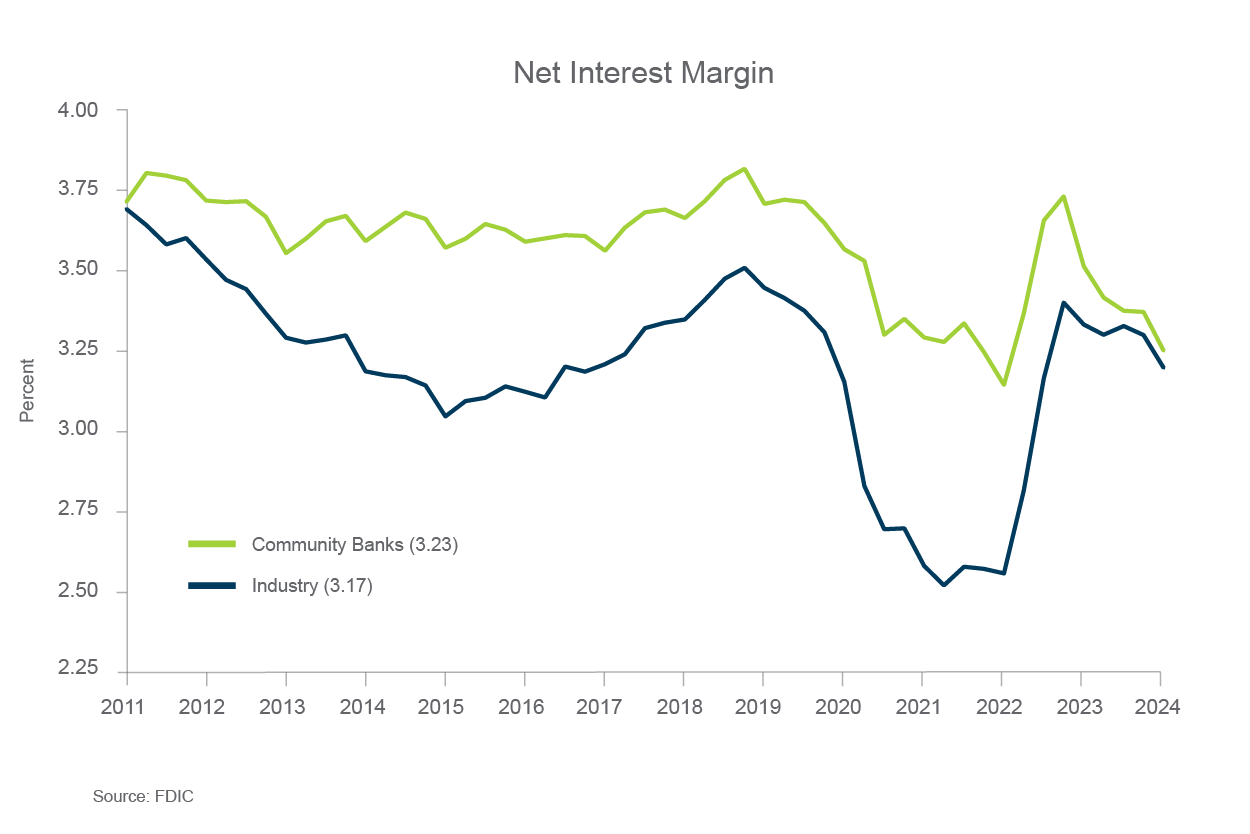

Despite remaining consistent in the prior quarter-over-quarter comparison, NIM (net interest margin) resumes the declining trend into 2024.

Community banks’ NIM dropped in the first quarter to 3.23%. NIM was down 26 basis points from the year-ago quarter. The yield on earning assets increased 66 basis points, and the cost of funds increased 92 basis points. Despite the significant decline, the community banks’ NIM performance continued to prevail the overall banking industry’s NIM of 3.17%, which declined 10 basis points in first quarter 2024. The banking industry’s NIM dropped seven basis points below the pre-pandemic average NIM of 3.25% for the first time since third quarter 2022.

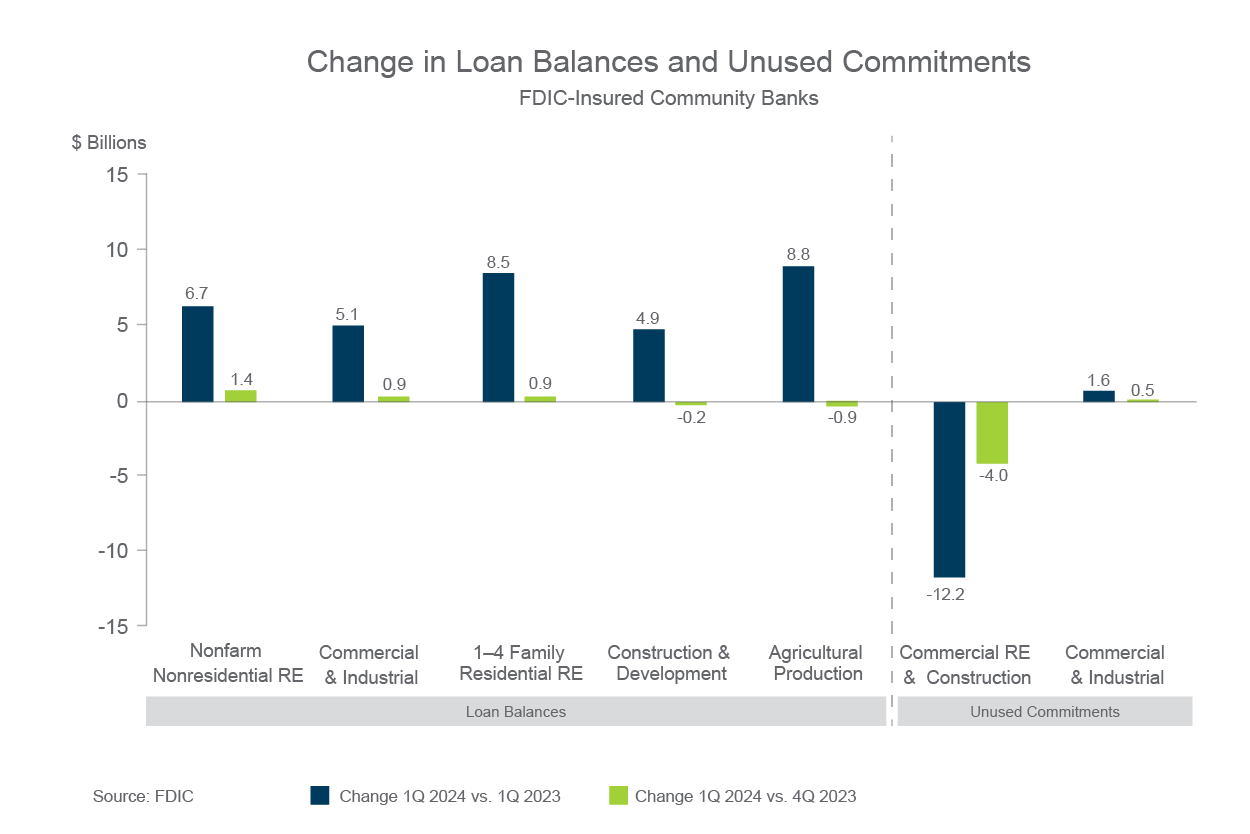

Loan and lease balances continued to grow in first quarter 2024, with 62.9% of community banks reporting quarterly loan growth.

Loan and lease balances continued to see widespread growth in first quarter 2024. Community banks saw loan growth in all major portfolios except construction and development loans and agricultural production loans. Nonfarm, nonresidential commercial real estate (CRE) loans exhibited the most growth from fourth quarter at 1.4%, followed closely by residential real estate and C&I loans, both at 0.9%. Total loans and leases grew 7.1% from one year ago. This year-over-year growth was also driven by farm, residential real estate and nonfarm, nonresidential CRE loans, which showed growth year-over-year of 8.8%, 8.5%, and 6.7%, respectively.

Loan and lease balances continued to see widespread growth in first quarter 2024. Community banks saw loan growth in all major portfolios except construction and development loans and agricultural production loans. Nonfarm, nonresidential commercial real estate (CRE) loans exhibited the most growth from fourth quarter at 1.4%, followed closely by residential real estate and C&I loans, both at 0.9%. Total loans and leases grew 7.1% from one year ago. This year-over-year growth was also driven by farm, residential real estate and nonfarm, nonresidential CRE loans, which showed growth year-over-year of 8.8%, 8.5%, and 6.7%, respectively.

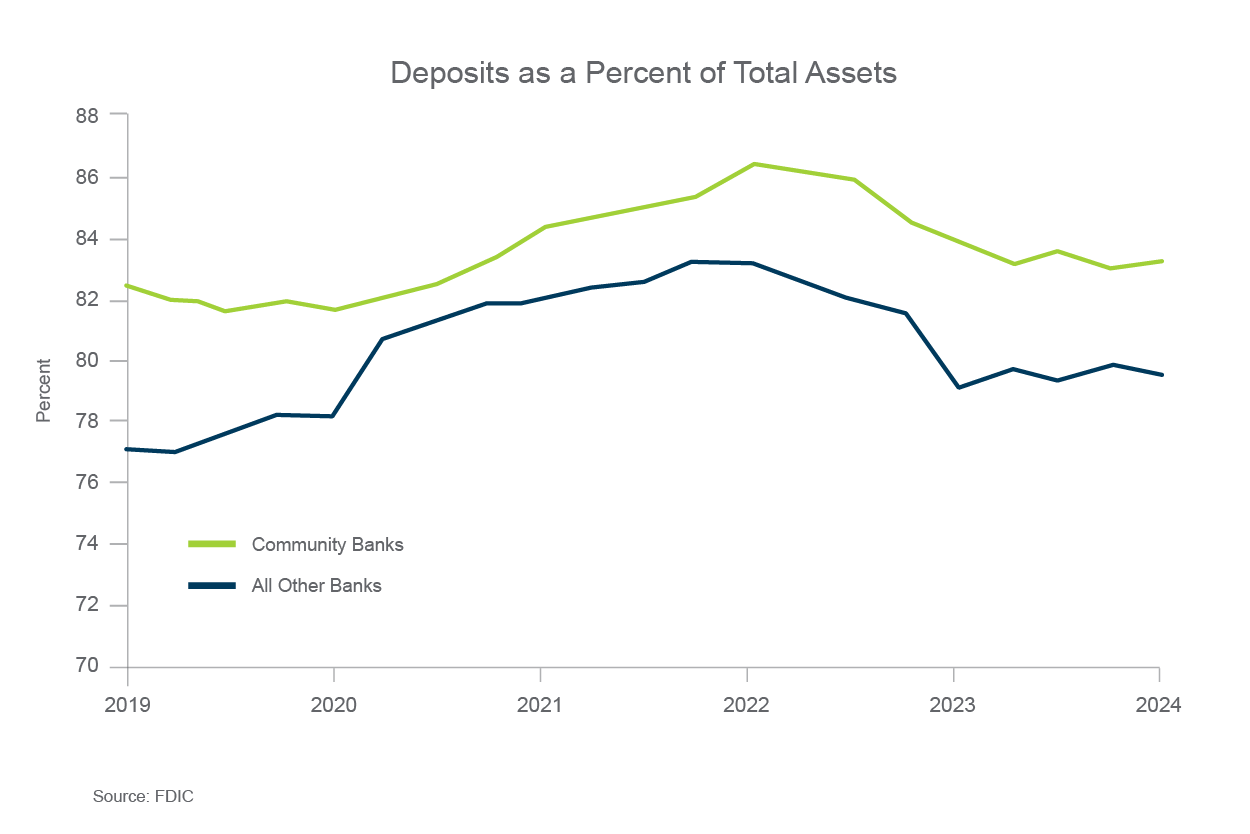

More than half of all community banks (61.9%) reported an increase in deposit balances from the previous quarter.

First quarter 2024 showed growth in interest-bearing deposits of $35.6 billion but a decline in noninterest-bearing deposits of $12.9 billion from the previous quarter. Total assets at community banks increased 0.8% quarter-over-quarter and 4.0% year-over-year. Community banks’ total deposits as a percentage of total assets have been declining since reaching 86.71% in first quarter 2022; however, community banks have yet to return to the low of 81.75% shown in first quarter 2020. The average total deposits as a percentage of total assets has shown year-over-year increases of 0.41%, 2.57%, and 0.95% from 2019 through 2022, respectively; however, the community banks have shown a year-over-year decrease in average total deposits as a percentage of total assets of 2.44% and 0.15% into 2023 and the first quarter of 2024, respectively.

BerryDunn and Stifel recently held the 11th annual New England Banking Summit on May 30th in Portsmouth, New Hampshire. The firms were joined by over 30 different organizations and touched on current economic trends, accounting standards and tax updates, strategies for maximizing benefits and minimizing risks within financial institutions, navigating change, and ways to optimize Current Expected Credit Losses (CECL) processes. Chief Economist Lindsey Piegza, Ph.D. from Stifel, spoke, amongst other things, about the May Federal Open Market Committee (FOMC) meeting. She noted she believes the FOMC will remain on the sidelines for longer than previously expected. The FOMC stated that “readings on inflation have come in above expectations.” This could continue to put downward pressure on NIMs more so than already seen in the above graph.

The inactivity by the FOMC has also wreaked havoc on some bank’s budgets, especially those that optimistically budgeted some rate cuts in 2024. But this projected inaction should not be reason to declare defeat. Bankers are great at pivoting, which was proven continuously during the pandemic. This is another opportunity for banks to pivot and change strategic direction. For instance, this may be a time to focus on other, non-interest revenue sources, or possibly revisit recurring operating costs for opportunities to streamline.

As always, BerryDunn’s Financial Services team will be right alongside you, navigating every rise, bump, and drop of this rollercoaster ride together.