From the complexities of the regulatory environment, to staffing shortages and skill deficits, to the rising costs of technology, healthcare organizations today face greater challenges than ever before. Among the key trends threatening a provider's financial stability is the surging rate of claim denials, resulting in delayed payments, increased operational costs, and potential revenue loss. For many providers, the financial strain of managing these denials has become unsustainable.

So, what can your organization do to thrive in the face of today’s revenue cycle reality? Consider shifting from managing denials after they occur to preventing them before they happen. By proactively tackling denials at the source, your organization can both lower collection costs and also enhance your financial stability through improved cash flow.

Why focus on denials prevention?

Denied claims can mean denied revenue. Denials happen along the entire revenue cycle, preventing your organization from being paid for services in a timely way––or at all. Your options have been to rework the claim or write it off, and both will cost you:

- Rework is expensive. On average, rework costs $25 per claim and adds at least 14 days to pay. Success rates vary between 55% and 98%.

- Write-offs are a net loss. The industry only appeals 35% of denied claims, absorbing write-off losses that range from 1% to 5% of net patient revenue.

A better alternative is to prevent denials from occurring in the first place. Below are five strategies to help your organization avoid claim denials and collect what’s due.

.svg)

Proactive denials prevention: A glide path

Creating a system for preventing denials requires an assessment of where you are today, a committee of stakeholders, the setting of sustaining goals, and continued monitoring.

1. Baseline analysis: Where are you today?

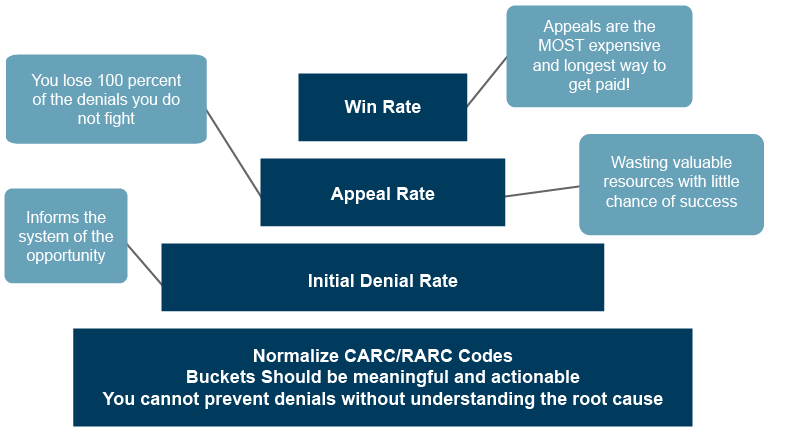

You can’t prevent denials without understanding their root cause. Begin with a holistic baseline assessment of the underlying causes by payer and denial categories. This analysis will help identify and correct potential issues related to clinical denials, underpayments, billing and administrative processes, and coding and compliance issues.

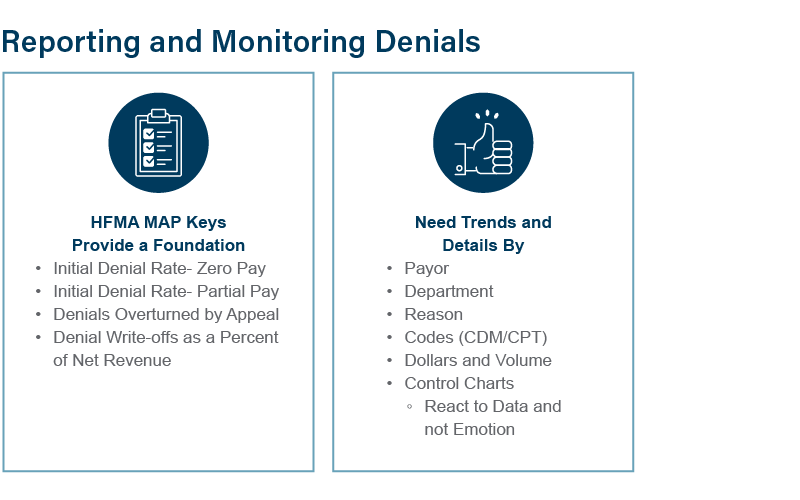

The Healthcare Financial Management Association’s MAP Keys provide a foundation for monitoring and reporting denials. These industry-standard metrics or KPIs are a way to track your organization’s revenue cycle performance using objective, consistent calculations.

Key metrics include your organization’s:

- Initial denial rate – zero pay

- Initial denial rate – partial pay

- Denials overturned by appeal

- Denial write-offs as a percent of new revenue

Note: Appeals are the most expensive and longest way to get paid. But you lose 100% of the denials you don’t fight!

Track trends and details by:

- Payor

- Department

- Reason

- Codes (CDM/CPT)

- Dollars and Volume

- Control charts

2. Accountability: Establish a Denials Prevention Committee

Before you begin shifting from denials management to denials prevention, set your organization up for success by creating a Denials Prevention Committee and securing the solid support of senior leadership. Your team should include stakeholders across the organization, including:

- Revenue integrity

- Managed care

- Care coordination

- Billing

- Coding

- Patient access

- IT

- Department leaders

- Special guests, such as payor representatives and clinical leaders

3. Set your goals: What is possible?

The Denials Prevention Committee is accountable for identifying the patterns and trends that are leading to denials and recommending preventative measures. With insight from your baseline analysis, the committee will identify the top denial issues, their root causes, and potential actionable measures to avoid future denials. Prevention measures could include:

- Educating and training staff on common denial causes and best practices for accurate coding and claim submission to prevent errors

- Identifying opportunities to build in system automation to prevent denials

- Creating a better understanding of the specific billing rules and requirements of each payor to tailor claims accordingly

4. Results: Active denials prevention and monitoring

The committee is charged with implementing denial avoidance measures, monitoring, and reporting on the results. The process includes regular reporting on initial denial, appeal, and win rates to determine over time if the measures are working, and if the results are sustainable.

Tracking and trend analysis can help identify:

- New opportunities for denial prevention

- Areas that should be prioritized

- Emerging issues that should be addressed

- Payor behavior trends

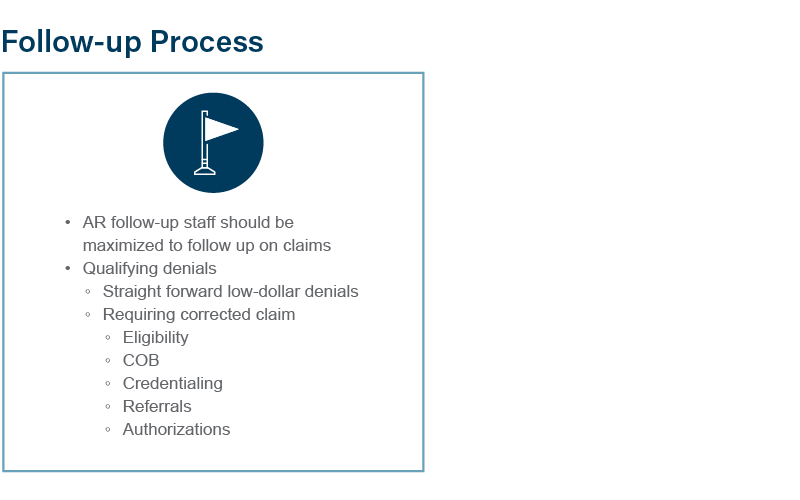

5. Follow-up process: Who should work denials?

Even the most effective prevention measures won’t eliminate all claim denials. Working claims is part of the AR follow-up process––but it’s important to allocate the right resources at the right time. Consider creating a decision matrix to help determine who works your denials, with criteria based on both denial complexity and dollar value. For example, assign your:

- Dedicated AR follow-up staff to work straightforward, low-dollar denials and claim corrections related to eligibility, COB, credentialing, referrals, and authorizations

- Denials specialist to focus on high-dollar claims that may require specific payor forms, cover letters, rebilling, etc.

- Clinical Appeals RN to work high-dollar complex and clinical denials requiring a formal appeal letter with evidence from the medical record to support the claim

Setting up a dollar threshold can help guide resource allocation. For example:

- AR follow-up staff: $200 - $4,999

- Denials specialist: $5,000 - $34,999

- Clinical Appeals RN: $35,000+

Once your denial efforts have been exhausted, consider outsourcing write-offs to a third-party agency for one final attempt. Weigh the potential for more revenue against the balance remaining on the books for a longer period.

Ultimately, shifting to denials prevention and effectively allocating your follow-up resources will help reduce your administrative costs, improve your cash flow, and enhance patient satisfaction. Don’t let due dollars go unpaid!

With experts along the entire continuum of care, BerryDunn's approach to revenue cycle optimization focuses on cash acceleration, revenue integrity, and helping to ensure that every dollar owed is collected. Based on best practices, we help bolster performance and improve the efficiency and effectiveness of your revenue cycle. Learn more about our team and services.